In an increasingly digital world, the security of personal information has become paramount. If you find that a scammer has obtained details such as your name, birthdate, address, email, and phone number, it’s crucial to understand the potential risks and the steps you can take to mitigate them.

Potential Risks

- Identity Theft: Identity theft is perhaps the most severe risk. Scammers can use your personal information to impersonate you, applying for credit cards, loans, and even government benefits in your name. Since they have your birthdate and address, they can often bypass security checks that use this information as verification.

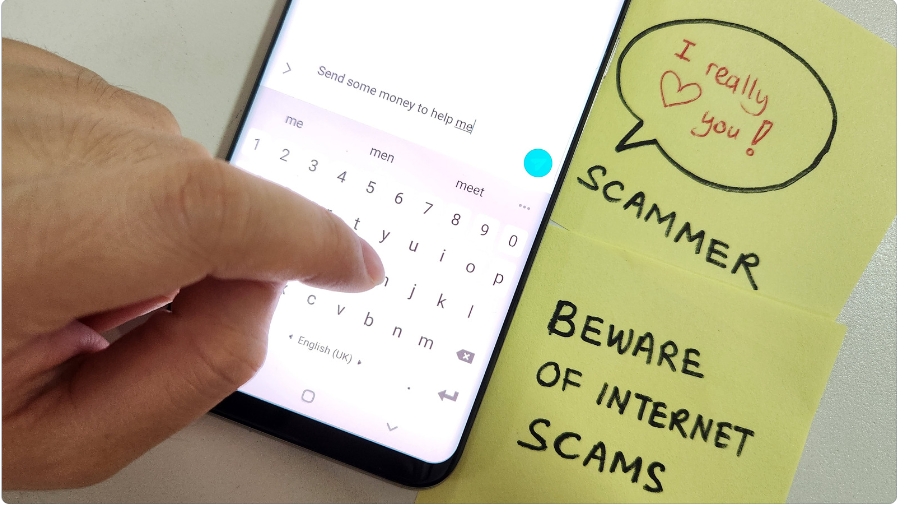

- Phishing Scams: Armed with your personal details, scammers can send highly personalized phishing emails or texts. These messages might mimic legitimate communications from banks or popular services, designed to trick you into revealing sensitive information like social security numbers or login credentials.

- Account Takeovers: Your email and phone number are keys to the kingdom. Many password recovery systems use email or SMS verification, allowing scammers to potentially reset passwords and gain access to a wide range of your personal and financial accounts.

- Fraudulent Charges and Accounts: With enough information, scammers can forge your identity to make unauthorized purchases or open new accounts. This could not only lead to financial loss but also damage your credit score and financial reputation.

- Social Engineering: Scammers might use the obtained information to manipulate or deceive your contacts, pretending to be you in distressing situations to solicit money or information from friends and family.

Protective Steps You Should Take

- Monitor Your Financial Statements: Regularly review your bank, credit card, and other financial statements for any unauthorized activity. Set up alerts with your financial institutions to notify you of any new transactions.

- Secure Your Accounts: Immediately change your passwords for all online accounts, especially for your email and financial services. Opt for two-factor authentication wherever available, which adds an extra layer of security beyond just the password.

- Credit Freeze: Consider placing a credit freeze on your files with the three major credit bureaus (Equifax, Experian, and TransUnion). A credit freeze makes it harder for identity thieves to open accounts in your name, as it prevents creditors from accessing your credit report.

- Fraud Alerts: Place a fraud alert on your credit reports, which warns creditors that you may be an identity theft victim and they should verify that anyone seeking credit in your name is actually you.

- Stay Vigilant Against Scams: Be especially cautious of unsolicited communications. Scammers may attempt to use the gathered information to create very convincing emails or calls. Always verify the authenticity of requests for personal information by contacting the companies directly using a trusted method.

- Report to Authorities: Notify the Federal Trade Commission (FTC) via IdentityTheft.gov, which also provides specific recovery steps. Additionally, contact your local police department to file a report, particularly if you have evidence of fraud or identity theft.

- Educate Yourself and Others: Stay informed about the latest scam tactics and educate those around you. Awareness is a powerful tool in preventing further exploitation.

Conclusion

Having your personal information compromised is undoubtedly distressing, but taking decisive, informed action can help protect your identity and financial health. By understanding the risks and implementing strong preventative measures, you can significantly reduce the potential for damage and quickly respond to any incidents that do occur.